BTC Price Prediction: $150K Target in Sight as Institutional Momentum Builds

#BTC

ArrayBTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

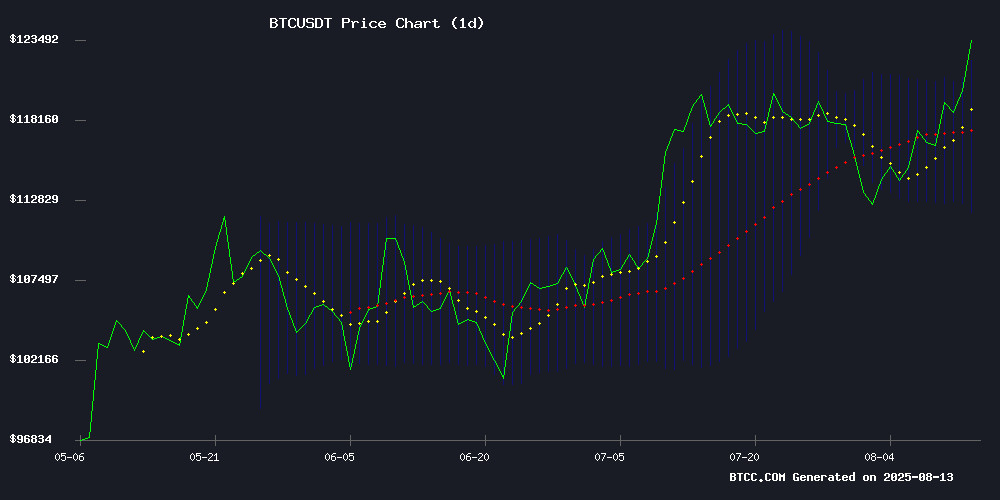

BTC is currently trading at, comfortably above its 20-day moving average (MA) of $116,835.85, indicating a bullish foundation. The MACD histogram remains negative (-139.03), suggesting short-term consolidation, but the proximity of the MACD line (1,294.44) to the signal line (1,433.47) hints at potential momentum reversal. Bollinger Bands show price hovering NEAR the upper band ($121,114.62), reflecting strong buying interest. Analyst Robert from BTCC notes:

Market Sentiment: Institutional Accumulation Offsets Short-Term Profit-Taking

News headlines reveal a tug-of-war between institutional demand (Ark Invest’s expanded Block position, Nasdaq firm’s $760M bid tease) and retail caution (Odin.fun withdrawals, miner distributions to Binance). Robert highlights:Liquidity constraints at this price level may amplify volatility.

Factors Influencing BTC’s Price

Bitcoin Retreats From $122K as Traders Assess Market Momentum

Bitcoin's rally faltered near the $122,000 resistance level, with the cryptocurrency now trading around $119,053. This pullback follows a week of aggressive price discovery that saw BTC reclaim historic highs. Market observers are scrutinizing exchange volume patterns to gauge whether the uptrend retains broad support.

Binance's outsized share of trading activity—reportedly double that of all other exchanges combined during earlier 2024 peaks—has emerged as a key metric. Analyst BorisVest notes diminishing volume expansion across platforms during subsequent rallies, suggesting potential fragility in the current price structure. The concentration of liquidity on a single exchange raises questions about market depth.

Ark Invest Expands Block Inc. Position as Bitcoin Strategy Gains Momentum

Ark Invest's flagship ETFs aggressively accumulated Block Inc. shares this week, signaling continued confidence in the fintech firm's bitcoin-integrated payment ecosystem. The ARK Innovation ETF (ARKK) led purchases with 152,980 shares, supplemented by ARKW's 69,526 and ARKF's 39,957 share acquisitions—totaling 262,463 new positions despite Block's stock dipping to $73.03, a July low.

The buying spree coincides with Block's 12% monthly gain, contrasting its 4% weekly decline. Cathie Wood's firm appears to be capitalizing on short-term weakness in the Square parent company, which remains strategically positioned to benefit from institutional Bitcoin adoption through its Cash App ecosystem.

Nasdaq-Listed Firm Teases $760M Bitcoin Purchase in Single Bid

David Bailey, CEO of Bitcoin-native holding company Nakamoto, has ignited crypto market speculation with a bold announcement: a planned $760 million BTC purchase executed in one bid. The move, initially framed as a $1 billion 'dream' buy, was later adjusted to reflect actual capital commitments from a recent financing round.

The countdown to the purchase spanned over 14 days, with strategic messaging blurring the line between marketing spectacle and institutional trading strategy. Market observers remain divided on whether the $240 million gap between the initial $1 billion claim and final $760 million figure represents calculated positioning or last-minute adjustments.

This development follows Nakamoto's merger with a Nasdaq-listed entity and a financing round reportedly securing up to $710 million in capital. The public nature of the buy signal—delivered via social media with countdown timers—marks a new chapter in institutional crypto adoption tactics.

Bitcoin’s Long-Term Holder Dynamics Signal Shift in Market Behavior

Bitcoin's long-term holders (LTHs) are reducing balances at cycle lows, marking a departure from historical patterns. The Hodler Net Position Change shows a -21.5K BTC outflow, yet sell pressure remains subdued compared to prior bull markets.

BTC briefly touched $122,312 before settling at $118,631, maintaining a 3.6% weekly gain despite a 2.43% daily dip. This divergence suggests LTHs are distributing holdings more gradually, potentially creating a healthier foundation for the $120K breakout.

Market observers note the Long-Term Holder Sell-side Risk Ratio continues to decline—a bullish indicator when paired with shrinking profit-taking. 'The absence of urgent selling could extend the rally's legs,' remarked one analyst reviewing Sentora's on-chain data.

Odin.fun Users Panic as Suspicious Withdrawals Drain Bitcoin Deposits

Odin.fun, a cryptocurrency platform, has paused trading following suspicious withdrawals that drained roughly 58.2 BTC from its deposits. The incident was flagged by an X user, @web3xiaoba, who noted a drop in bitcoin holdings from 291 BTC to 232.8 BTC. Two addresses were linked to the exploit, which allegedly manipulated liquidity pools to extract BTC without leaving paired assets behind.

Founder Bob Bodily confirmed the pause in trading, stating the move was necessary to protect user funds during the investigation. This event echoes a similar breach in April 2025, when Odin.fun's account was compromised, leading to unauthorized asset clearances. The platform's native token, ODINDOG, plummeted 40%, with Ripple effects across other hosted tokens.

Market sentiment has soured, reigniting debates over platform security and trust. The community remains divided between sympathy for the team and suspicion over recurring vulnerabilities.

Bitcoin Miner Distributions to Binance Signal Potential Pullback

Bitcoin miners are accelerating transfers to Binance, sparking concerns of an impending price correction as BTC hovers NEAR its all-time high. Late July saw a double-top spike in miner outflows, followed by sustained above-average exchange deposits throughout early August—including single transactions exceeding 10,000 BTC.

The pattern diverges sharply from April-June's subdued activity, resembling strategic stockpiling rather than routine operations. Analysts interpret the movement as miners capitalizing on peak prices to address post-halving treasury requirements or operational costs. Historical data suggests such concentrated exchange inflows often precede short-term downside volatility.

Bitcoin Edges Higher as Traders Digest Mixed US Inflation Data

Bitcoin rose 1.02% to $119,745 as July's CPI report met expectations with a 0.2% monthly increase, keeping annual inflation steady at 2.7%. Core CPI's 0.3% gain - the sharpest since January - pushed the annualized figure to 3.1%, maintaining pressure on Fed policy.

The inflation data reinforces market expectations for a September rate cut, particularly after recent weak jobs reports. However, questions about data quality persist after the BLS suspended price collection in some cities, with imputed data now representing 35% of June's CPI figures.

Technically, BTC faces resistance near $117,335 (23.6% Fibonacci level) as traders weigh the implications of sticky core inflation against softening economic indicators. The cryptocurrency's movement suggests cautious Optimism amid shifting macroeconomic winds.

Quantum Computing Breakthroughs Pose No Immediate Threat to Bitcoin Security, Says Google Expert

Recent advancements in quantum computing by Microsoft, Google, and IBM have sparked concerns in the cryptocurrency community about potential vulnerabilities in blockchain encryption. Microsoft's Majorana 1 chip, utilizing novel 'topoconductor' materials, claims a path toward million-qubit devices capable of solving problems beyond classical computing's reach.

Google veteran Graham Cooke dismisses the panic, asserting Bitcoin's cryptographic strength exceeds even the fabric of spacetime. The 340 undecillion possible seed phrase combinations in Bitcoin wallets remain impervious to current quantum capabilities, despite industry progress.

Google's Willow chip and IBM's public roadmap continue advancing quantum research, but practical applications for cracking elliptic curve cryptography remain theoretical. 'Your wallet's math is stronger than the fabric of spacetime itself,' Cooke tweeted, highlighting the vast combinatorial protection inherent in Bitcoin's design.

Bitcoin's Liquidity Dilemma: Momentum Meets Critical Juncture

Bitcoin's rally past $120,500 has reignited bullish sentiment, but Swissblock analysts caution that liquidity trends now hold the key to sustained price discovery. The cryptocurrency's network strength scores 82/100, while liquidity lingers at a neutral 52 – a combination that historically precedes continuation rallies when liquidity expands.

Market observers note the precarious balance: Should liquidity dip below 40 while network activity remains elevated, it may signal an impending correction. "Breaking all-time highs is just the opening act," notes Bitcoin Vector's report. "The real test is whether institutional inflows can fuel the next leg up."

Genius Group Plans Secondary Stock Listing in Asia, Eyeing South Korea

Genius Group, a Bitcoin treasury firm listed on the NYSE since April 2022, has approved plans for a secondary stock listing in Asia. The MOVE aims to attract additional liquidity, fair pricing, and enable 24-hour trading. South Korea leads the shortlist due to its dynamic retail investor culture and strong capital markets.

CEO Roger James Hamilton highlighted Asia's nascent stage in public Bitcoin treasury companies, positioning Genius Group as a potential regional leader. Other markets under consideration include Australia, Malaysia, Thailand, Hong Kong, and Japan. A final decision is expected within two to three months.

Speculation Mounts Over Strategy's $46B Bitcoin Holdings as Potential US Government Backdoor

Rumors are swirling around Strategy's colossal Bitcoin treasury, with analysts suggesting the $46 billion stash could serve as a covert reserve for the US government. Tom Lee, a prominent Wall Street strategist, has fueled these speculations by revealing the company controls 3.2% of Bitcoin's circulating supply—a position that may grow to 5% of the network.

The theory gained traction when crypto analyst Lupin cited Lee's comments about Michael Saylor potentially acquiring BTC on behalf of federal interests. Such accumulation WOULD be politically untenable if pursued openly by the government itself, given the market disruption it would cause. Strategy's publicly stated goal of amassing 1 million BTC now carries geopolitical undertones.

How High Will BTC Price Go?

Robert projects a 25% upside to $150,000 by Q4 2025, contingent on holding the 20-day MA. Key levels to watch:

| Scenario | Price Trigger | Target |

|---|---|---|

| Bullish | Close above $122K | $150K |

| Neutral | $116K-$122K range | $130K |

| Bearish | Break below $112.5K | $105K |

Catalysts include institutional bids (>$760M), reduced miner selling pressure, and resolution of US government Bitcoin holdings speculation.